E-file (Heavy Vehicle Use Tax) HVUT Form 2290 Now for 2022-2023 Tax Period

E-File Your Form 2290 Now for the 2022-2023 Tax Year! E-File HVUT 2290 Now

Why Should You Choose FILE HVUT for your

Form 2290 Filing?

Best In The Industry

E-file Form 2290 Heavy Vehicle Use Tax (HVUT) to get your Stamped Schedule 1 for $14.90 with an unlimited US-based phone, chat and email support, and free VIN corrections.

IRS APPROVED E-FILE PROVIDER

We are the best IRS authorized Form 2290 e-file provider. We have tons of experience to successfully e-file Heavy Vehicle Use Tax (HVUT) Form 2290.

Safe and Secure

As an IRS-authorized Form 2290 e-filer, the data-transfers and payments made through our portal are safe and secure.

Guaranteed Schedule 1 or Money Back

We will guarantee that you will be receiving your Schedule 1 for Sure or your Money Back.

Get 2290 Schedule 1 Minutes

You will receive your Schedule 1 in Minutes after filing your Heavy Vehicle Use Tax return with us.

Free VIN Correction

If you have entered your VIN wrongly on your previously filed Heavy Vehicle Use Tax return, and have filed it with our system, you can correct your VIN for FREE.

Click here to know more information about Form 2290.

File your 2022-2023 HVUT Form 2290 in 4 Simple Steps

Create an account

- Register as a new user or login

- Gather details related to your truck and business.

Enter your data

- Enter your business and truck information

- Choose from the 3 IRS payment options

E-FILE

FORM 2290

- Let the program review and check your info for any errors

- Instantly transmit to the IRS

GET

SCHEDULE 1

- Receive your HVUT Stamped Schedule 1 in minutes

- Get alerts by text or fax

Click here to know more information about Form 2290.

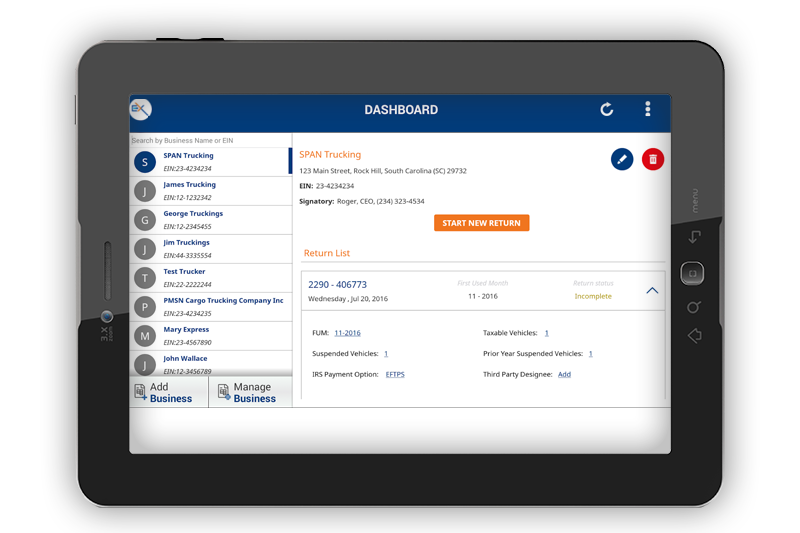

E-File HVUT Form 2290 NowHVUT Form 2290 Filing Solution for Tax Professionals!

Manage Multiple Businesses under one account

Handle e-file for Form 2290 and Form 8849 for all your clients in one place.

Add Clients’ Business Details Easily

Easily import multiple clients’ business details in one step and their vehicle information using our Excel template.

Discounts and Flexible Pricing

Take advantage of our discounts and flexible pricing for HVUT 2290 Filing filing specially available for tax professionals like you.

Dedicated Support

Get the assistance that you need in managing your account and filing with our exclusive dedicated account manager assigned to you.

Visit https://www.expresstrucktax.com/ for more information.

Helpful Free Tools to Keep your Trucking Business Moving

HVUT Tax Calculator

Take the guesswork out of estimating your taxes with ExpressTruckTax’s Free HVUT Calculator. Quickly figure out your 2290 tax amount and know how much your

HVUT will be.

IFTA Tax Calculator

Make your IFTA reporting hassle-free with our free IFTA calculator.

Calculate your IFTA taxes online. Simple, easy, and accurate.

Trusted by owner-operators like you.

Customer Testimonial

“Thank you so much for your help. I overpaid with ***2290 and they wanted to charge me to fix my VIN number. Not only did you guys let me e-file my VIN correction, but you let me do it for FREE. I can’t thank you enough!”

-Hank P, Pennsylvania

HVUT Form 2290 - HEAVY HIGHWAY VEHICLE USE TAX RETURN

IRS Form 2290 is also referred as Heavy Highway Vehicle Use Tax Return. You have to file Form 2290 annually if you operating heavy vehicles on public highways at registered taxable gross weight equal to or exceeding 55,000 pounds.

The gross taxable weight of a vehicle can be determined by adding the actual unloaded weight of vehicle fully equipped for service, actual unloaded weight of any trailers or semi-trailers equipped for service normally used in combination with the vehicle, weight of the maximum load generally carried on the vehicle and its trailers or semi-trailers used in the vehicle. The total will be your gross taxable weight.

WHEN IS THE DUE DATE TO FILE HVUT FORM 2290?

The due date to e-file IRS Heavy Vehicle Use Tax (HVUT) Form 2290 falls between July 1st to August 31st. However, your due dates would change if your first used month differs from those. If a vehicle is used for the first month then its Heavy Vehicle Use Tax (HVUT) must be paid within the last day of the next month.

Visit https://www.expresstrucktax.com/hvut/irs-form-2290-due-date/ to know the due date for vehicles that are first used other than the July.

HOW IS HEAVY VEHICLE USE TAX (HVUT) CALCULATED?

Heavy vehicles are split up into different categories based on their gross taxable weights. For each category, there are different taxation amount which needs to be paid.

| Gross Taxable Weight | Heavy Vehicle Use Tax (HVUT) Rates |

|---|---|

| Below 55,000 lbs | No tax |

| 55,000-75,000 lbs | $100 plus $22 per 1,000 pounds over 55,000 lbs |

| Over 75,000 lbs | $550 |

WHO MUST FILE FORM 2290 & PAY HEAVY VEHICLE USE TAX (HVUT)?

Heavy Vehicle Use Tax must be paid for taxable heavy vehicles which are registered in an individual’s name under any US state, DC, Canadian, or Mexican law at the time of its first use.

Visit https://www.expresstrucktax.com/hvut/irs-form-2290-due-date/ to know the due date for vehicles that are first used other than the July.

WHY SHOULD YOU E-FILE FORM 2290?

E-file Heavy Vehicle Use Tax (HVUT) Form 2290 because it’s easy and it saves a lot of your time. You can e-file your HVUT using FileHVUT and get your Stamped Schedule 1 within minutes. Your Stamped Schedule 1 is valid for the entire tax year.

Visit https://www.expresstrucktax.com/hvut/e-file-form-2290-online/ to know more about our E-filing features.